blogpage

Are Endowment Managers Better Than the Rest?

Apr 22, 2022 by Richard M. Ennis

- I compare five aspects of investing large educational endowments and public employee pension funds: (1) operating environment and culture, (2) institutional characteristics, (3) expense ratio, (4) risk habitat and (5) risk-adjusted performance.

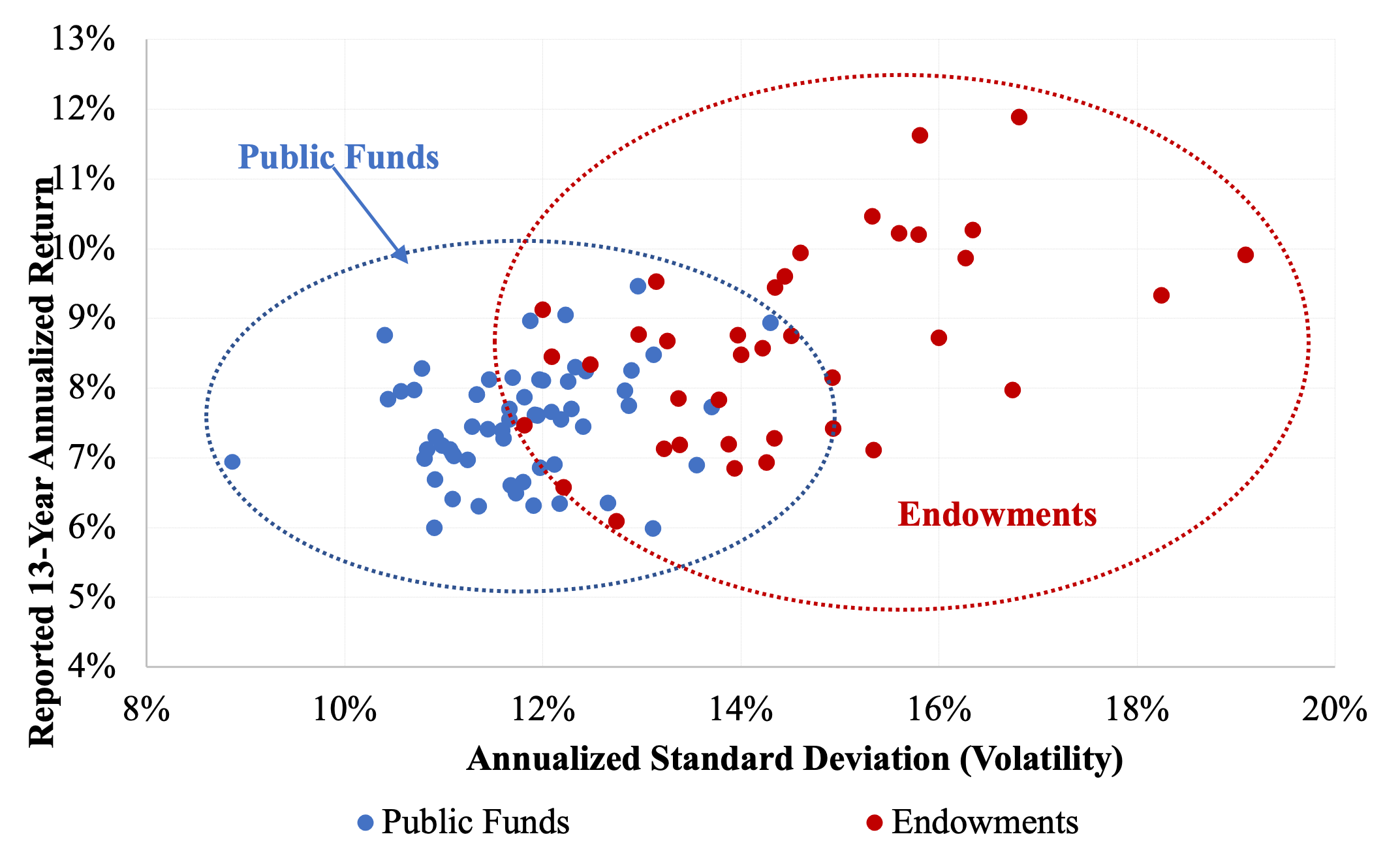

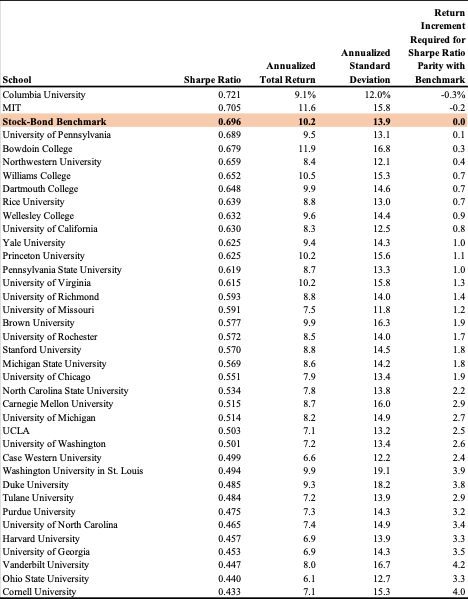

- The most significant measurable differences between the two types of investing institutions are: (1) the amount they spend on investment management and (2) the degree of risk they take. In terms of risk-adjusted performance, endowments have underperformed public funds for the 13 years ending June 30, 2021.

- There is no evidence that endowment managers have an edge over public fund managers of a type or magnitude that might translate to a performance advantage.

The Modern Endowment Story: A Ubiquitous United States Equity Factor

Mar 17, 2022 by Richard M. Ennis

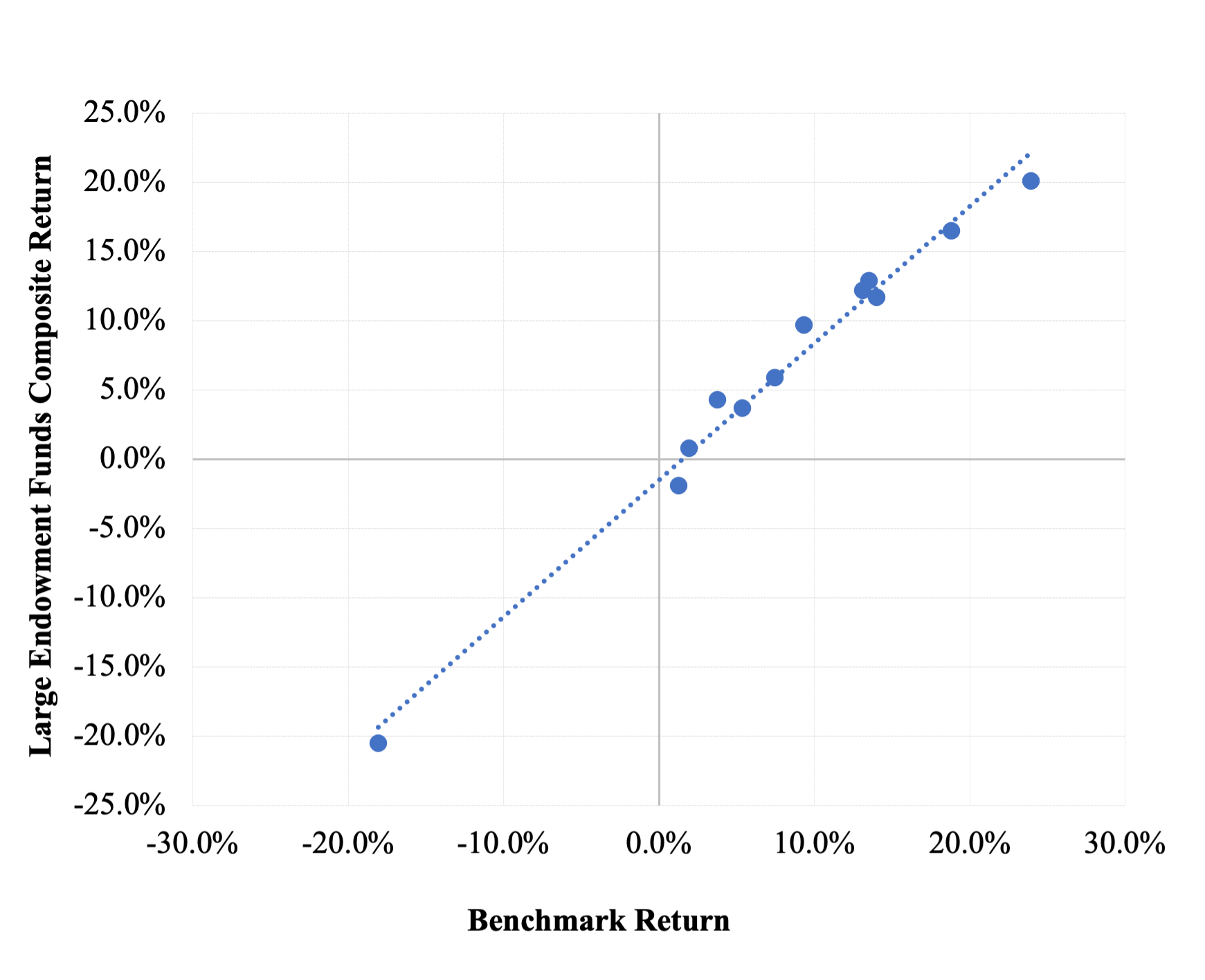

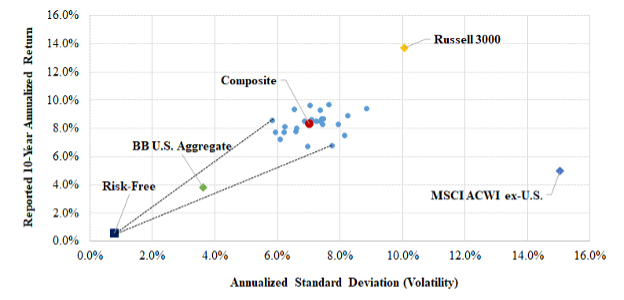

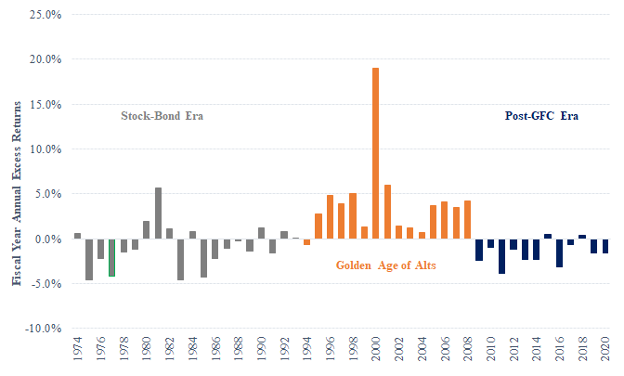

The endowment model, presumed to be a paradigm of value-adding asset class diversification, is a thing of the past. Large educational endowment funds in the United States have heavily concentrated their investments—public and private—in ones that are moderately to highly correlated with the Russell 3000 Index. I estimate that large endowments have underperformed by 2.24% to 2.5% per year over the 13 years ending June 30, 2021. I estimate that their annual cost of investing is approximately 2.5% of asset value. Given the extreme diversification of the composite, which comprises more than 100 large endowment funds with an average of more than 100 investment managers each, there is every reason to believe that cost is the principal cause of endowments’ poor performance. During the most recent 5–7 years, which I refer to as the Modern Era, endowments have exhibited an effective US equity exposure of 97% of asset value, with frictional cash accounting for 3%. The overwhelming exposure to the US equity market raises important strategic questions related to risk tolerance and diversification for trustees and fund managers.

The Fairy Tale of Alternative Investing

Mar 17, 2022 by Richard M. Ennis

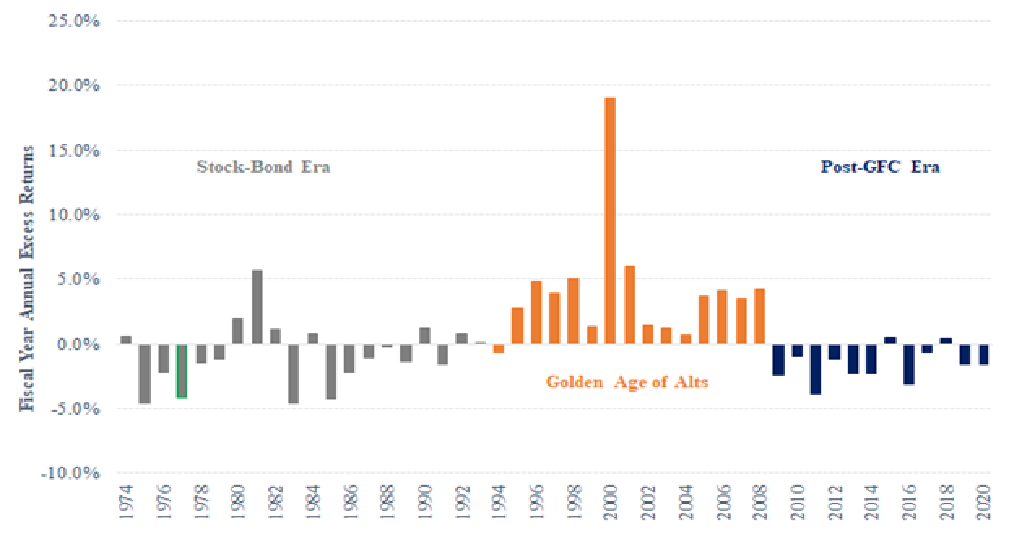

Advocates of alternative investments, such as private equity, real estate and hedge funds, ascribe various benefits to alts. These include volatility dampening, little or no correlation with stocks and bonds, and powerful diversifying effects. Some say that it is alts’ supposed defensive character that has prevented them from keeping up with stocks and bonds during the bull market following the Global Financial Crisis of 2008, and that there is reason to believe alts will be particularly good performers in the event stocks experience a bear market. None of these claims stands up to critical analysis.

Cost, Performance, and Benchmark Bias of Public Pension Funds in the United States: An Unflattering Portrait

Mar 17, 2022 by Richard M. Ennis

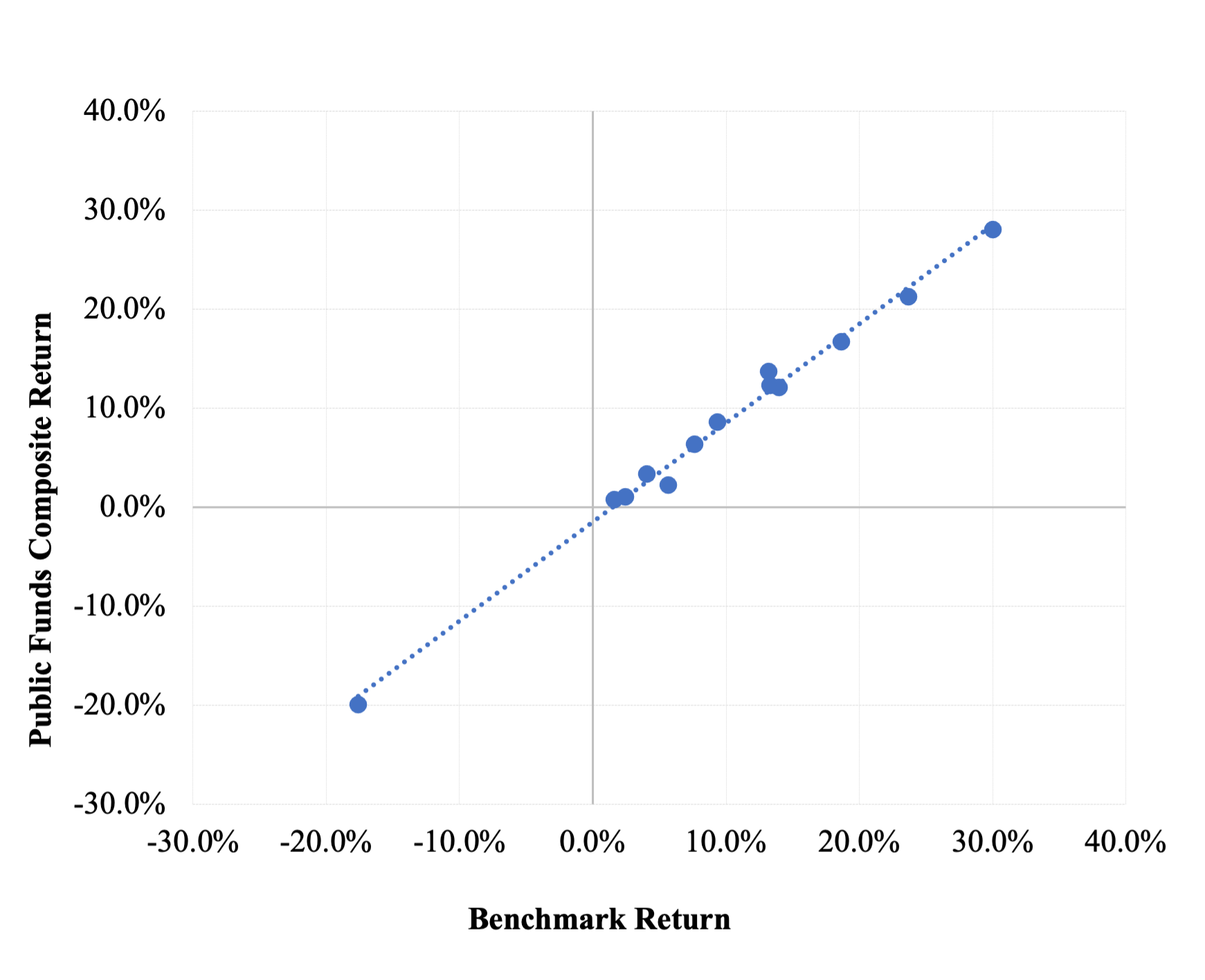

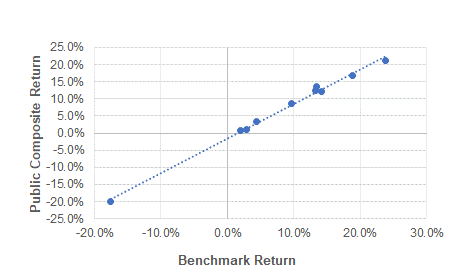

I estimate that statewide pension funds in the United States incur annual investment expenses averaging 1.2% of asset value. A sample of 24 of them underperformed passive investment during the decade ended June 30, 2020, by an average of 1.4% a year. And yet, those same funds report that they outperformed benchmarks of their own devising by an average of +0.3% a year for the same period. This sharp disconnect raises questions about the usefulness of the funds’ performance reporting, as well as their heavy reliance on expensive active management.

Overexposed? Public Pension Funds Have A Lot Riding On The U.S. Stock Market, Possibly Even More Than They Realize.

Mar 17, 2022 by Richard M. Ennis

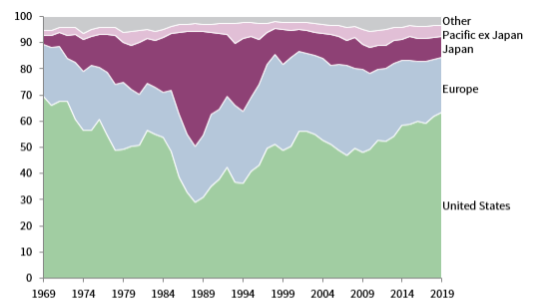

Despite efforts to diversify internationally, public pension funds in the US have a significant, latent home-equity bias. The home bias takes on added importance in light of the extraordinary valuation level of the US stock market. All in all, public funds are betting heavily on the home market and paying up to do so. Caveat!

Cutting Through the Fog of Asset Class Labels

Mar 17, 2022 by Richard M. Ennis

Institutional investors use myriad and often ambiguous asset class descriptions that obscure portfolio market exposures for anyone on the outside. This obfuscation makes it difficult to understand risk characteristics and complicates performance evaluation. Fortunately, analytical techniques exist to cut through the fog of asset class labeling.

The Endowment Model Defense That Wasn't

Mar 17, 2022 by Richard M. Ennis

In his essay, "Don't Give Up the Ship: The Future of the Endowment Model", Larry Siegel chooses to expound on active investing in conceptual terms, with occasional reference to endowment management. This rebuttal contends that the Siegel essay is long on intellectual theory and short on proof. It takes issue with the rationalization of endowments’ significant underperformance over 12 years and counting. The case for active investing looks past the elephant in the room — theory and evidence casting grave doubt on the merit of diversified — i.e., myriad-manager — active investing like that of endowments. The exceptionalism argument falls flat. The article sidesteps the glaring deficiencies of the endowment model. Siegel simply posits the presence of “skilled employees” in university investment offices who will get the job done despite obstacles of their own making. This rebuttal finds the explanation unconvincing and concludes the endowment model is dead as a door nail.

How to Improve Institutional Fund Performance

Mar 31, 2021 by Richard M. Ennis

Public employee pension funds, endowment funds and other nonprofit institutional investors in the U.S. have a serious performance problem. They have underperformed properly-constructed, passively-investable benchmarks by a wide margin since the Global Financial Crisis (GFC) of 2008, some 13 years ago. Moreover, they have underperformed with remarkable consistency. The poor performance is no accident. Rather, it is structural in nature. Improving performance will require that fund managers make significant changes in their approach to asset management. Institutional investors across the board would be better off investing purely passively. Evidence for this is compelling. Institutions determined to outperform market benchmarks should (1) simplify their approach to asset allocation, (2) use far fewer managers and (3) significantly reduce cost.

Failure of the Endowment Model

Nov 26, 2020 by Richard M. Ennis

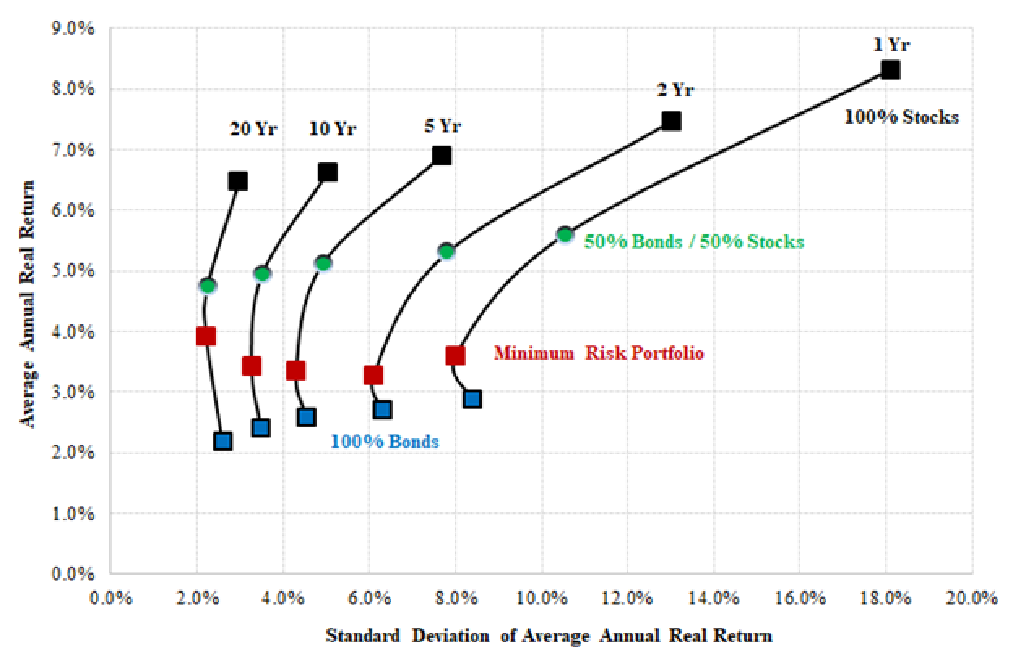

Large institutional investors in the U.S. commonly diversify their portfolios among 8-12 asset classes. This approach typically involves using more than 100 investment managers at a cost of 1-2% of asset value annually. Sometimes referred to as the Endowment Model, the approach has failed to provide a diversification benefit and has proven to be a serious drag on performance. The vast majority of institutional investors would be better off managing their funds passively at next to no cost in the configuration that best accords with their risk tolerance and other preferences.

Endowment Performance

Dec 01, 2020 by Richard M. Ennis

Endowment funds in the U.S., large and small, significantly underperform passive investment. Moreover, an analysis of the performance of 43 of the largest individual endowments over the 11 years ended June 30, 2019, reveals that none outperformed with statistical significance, while one in four underperformed with statistical significance. Alternative asset classes have failed to deliver diversification benefits and have had an adverse effect on endowment performance. Given prevailing diversification patterns and costs of 1 to 2% of assets, it is likely that the great majority of endowment funds will continue to underperform in the years ahead.

A Bad Year for Institutional Investors

Sep 04, 2020 by Richard M. Ennis

Most public pension funds and educational endowments report their annual investment results on a June 30 fiscal year basis. The year just ended was a bad one. These investors, in the aggregate, underperformed passively investable benchmarks by nearly 300 bps for the year, which is a wide margin by historical standards.

Institutional Investment Strategy and Manager Choice: A Critique

May 18, 2020 by Richard M. Ennis

In a recent

Journal of Portfolio Management article I looked critically at institutional investing in the U.S. I found:

- Large public pension funds underperformed passive investment by 1.0% per year in the decade ended June 30, 2018. The underperformance of large educational endowments was of 1.6% per year.

- The margins of underperformance closely approximate the respective (independently derived) cost of investment for the two fund types.

- Alternative investments ceased to be the diversifiers they once were and became a significant drag on institutional fund performance.

- Public pension funds are high-cost closet-indexers. The vast majority will inevitably underperform in the years ahead

Signature EnnisKnupp Advisory Themes

Sep 10, 2019 by Richard M. Ennis

Advisory themes played a vital role in the work of EnnisKnupp. We wanted all the clients to get the firm’s best thinking. As a means to that end we set out the firm’s position in various areas so that clients got the same advice, circumstances warranting. There were never more than 10 or so positions, or themes, most of which derived from our research and writing. We tried to put them down on paper from time to time, but that proved superfluous. The positions were forged in our internal discussions and day-to-day work. We knew them like we knew our own names. Here is a brief description of some of the most enduring EnnisKnupp advisory themes.

How to Sell Services

Jul 11, 2019 by Richard M. Ennis

In Never Bullshit the Client, I write about selling services, which is different from selling products. While I don’t claim to be an expert on selling services, I did learn a few things during my 40 years at it. This post explores what I have learned.

Big Bond Bust

Jul 08, 2019 by Richard M. Ennis

The following article was originally published in Financial Analysts Journal, Sep/Oct 2009, Vol. 65, No. 3: 6-8.

The Uncorrelated Return Myth

Jul 04, 2019 by Richard M. Ennis

The following article was originally published in Financial Analysts Journal, May/June 2009, Vol. 65, No. 3:6-10a.

Darwin and Investment Product Proliferation

Jul 01, 2019 by Richard M. Ennis

The following is adapted from the essay, “The Structure of the Investment Management Industry,” appearing in Financial Analysts Journal, July/August 1997, Vol. 53, No. 4:6-13.