The Endowment Model Defense That Wasn't

The endowment model is a subject of great interest to institutional investors, consultants and investment managers around the world. Trillions of dollars of institutional assets in the U.S. alone are managed along the lines of the endowment model. For many years the approach was venerated. More recently, it has been called into question. In my initial article, I show the endowment model has become severely dysfunctional. In “The Endowment Model is Just Active Management,” (Siegel ) Siegel does not speak to the endowment model directly. Rather, he discusses active investing in conceptual terms, with occasional reference to endowment management. He justifies active investing under certain rather non-restrictive conditions. He states that endowed institutions are better suited to succeed with active investing than are other institutional investor types. He says strong stock and bond markets are as much to blame for endowments’ subpar performance as anything and that while alternative investments have performed poorly, their day will come again. He concludes that endowment managers should stay the course.

ON THE ECONOMICS OF THE ENDOWMENT MODEL

Siegel says endowments’ poor performance is “...not representative of the underlying economics of the model.” I disagree. My research has proven that the poor performance is a direct result of the failed economics of the endowment model (EM). Alternative investments long ago ceased to be diversifiers as their trading markets became more liquid and pricing there came to be more closely aligned with that of public markets. For the same reason, the principal classes of alts ceased to be sources of alpha and became a serious drag on performance. As a result of this market evolution, the EM’s signature asset-class diversification scheme now imposes rigidity without benefit: Asset classes have become silos, tantamount to quotas for large-scale investing in pricey alternative investments of uncertain merit. One hundred or more investment managers for an endowment portfolio are way too many: Inefficient diversification abounds. Costs approaching 2% of asset value are implausible on their face. These are the economics of the EM, and they are conspicuously out of whack.

PICK YOUR PERIOD

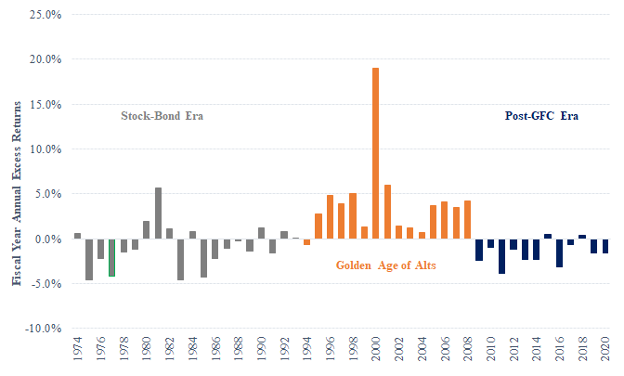

Siegel makes the point that the poor performance of the EM is “time-specific.” I would reply that all empirical results are time-specific. The issue is whether or not the results make sense in a fuller temporal context. Exhibit 1 illustrates the value-added achieved by large endowments over the longest time period available to us, which is 47 years.[1] It identifies three distinct eras of endowment performance. The first and third eras account for 32 of the 47 years. They come about as close as you can get to depicting the normal performance of diversified investment portfolios (and in this case, a composite of them). By this I mean the composite underperforms a passively-investable benchmark by the approximate margin of cost, or 0.8% of asset value in the first era (stocks and bonds only) and 1.6% of asset value in the third (post-GFC), when costly alternative investments averaged nearly 60% of endowment assets. The first and third eras conform neatly with a dictum among finance scholars that, to the extent markets are reasonably efficient, diversified portfolios can be expected to underperform properly constructed benchmarks by the margin of cost. At the same time, the middle era is anything but normal. And if it weren’t for that strikingly abnormal period of endowment performance, there would be no debate taking place now over a thing called the endowment model (that stopped working 12 years ago). There is nothing fluky about the the last 12 years. The mangled economics of the EM are simply expressing themselves in the form of rates of return.

Exhibit 1

47 Years of Excess (Risk-Adjusted) Return for Large NACUBO Endowments

ENDOWMENT EXCEPTIONALISM

Siegel makes the case for a kind of exceptionalism on the part of endowed institutions that should enable them to outperform other types of institutional investor. He discusses their freedom to invest without constraint.[2] His argument is that rich universities pay better than some other types of institutional investor and offer collegial work environments, which together enable them to attract highly skilled employees. In this vein, he writes they have “...highly respected chief investment officers that are chosen for their independence and intelligence....” He emphasizes the importance of “skilled investors” more than the particular strategy they might employ in managing money. He notes that university investment offices are typically nestled within elite institutions, many of which have distinguished faculty members (Nobel laureates, even) who can add intellectual firepower to investment management. He says that endowment managers rub elbows with captains of industry and finance by virtue of connections made through the graduate business school and board room. Investment managers from all over the world call on them, regarding them as very special clients. In his earlier paper, “Don’t Give Up the Ship: The Future of the Endowment Model” (Siegel 2021), Siegel avers, “Endowment funds have...structural advantages...that should allow them to earn above-market risk-adjusted returns in the long run.” That would make them exceptional to be sure.

Is endowment exceptionalism real? Is it myth? Some of both? Let’s see where logic (theory) and the facts (evidence) take us.

Theory

I assume the comparative advantages that Siegel identifies for endowment funds are not shared by the more ordinary public-employee (government-sponsored and -managed) pension funds in the U.S. Proceeding from that premise I compare the two investor types. Both are tax-exempt investors in the U.S. Both are institutional funds that would describe themselves as having an amply-long investment horizon for equity investing. Similar fiduciary standards apply to both. Both operate in the same highly competitive markets. Both diversify their investments extensively. They exhibit remarkably similar effective exposures to major stock and bond markets.[3] Their patterns of return-variability over time are virtually identical.[4] Dollars invested don’t know whether they are working for an Ivy League school or public school teachers. From a financial-markets-and-institutions standpoint, there is no difference between endowments and public pension funds in terms of how they might be expected to perform before costs.

Evidence

So, how have the two types of institutional investor performed side by side? Will we find a payoff to the cultural advantage Siegel ascribes to endowments? The answer is No. Large educational endowments have for many years underperformed large public pension funds. For the 12 years ended June 30, 2020, public pension funds had an alpha of -1.14% per year. The alpha of endowments for that period was -1.47% per year. The return patterns of the two investor types are nearly indistinguishable, except for their alphas.[5] Endowments’ greater negative alpha is in line with their greater cost of investing. This, in turn, is a consequence of their much greater holdings of alternative investments (approximately 60% of total assets versus approximately 30% for public funds). The results of this head-to-head comparison are starkly at odds with the thesis of exceptionalism.[6] So, theory and evidence trump culturalism when it comes to investing. Long live finance theory and evidence!

ACTIVE MANAGEMENT

Siegel discusses active management in largely theoretical terms, citing the scholarly work of Grinold and Kahn (2000) and his own work with Barton Waring (2003). He contends that if an investor believes they are skilled at picking winners, they should opt for active management over passive. It is unclear, though, how one is to know who is skilled before the fact. This is a problem when 99% of the people working in the field of institutional investing behave as if they fall into the skilled category, where they hope to be paid more handsomely than the few willing to relegate themselves to the unskilled category. He then asserts that, owing to the ostensible advantages discussed above, endowments have favorable prospects for value-added investing. The tenor of this rather academic discussion is supportive of active investing on the part of endowments, but short on substance.

Worse yet, in talking up the potential of active management, Siegel’s argument does not address directly the overwhelming evidence in the financial economics literature that active investment managers, collectively, do not even recover their costs let alone add value. We are talking hundreds of articles and dozens of books spanning more than half a century. He ignores the related “persistence” literature showing that outperforming managers in one period tend not to repeat as winners in the next period, highlighting the challenge of identifying skillful managers ahead of time.[7] He tiptoes around all of this, leaving his treatment of active management’s potential decidedly unbalanced.

APPLES, ORANGES AND LOW BETAS

Siegel says a strong stock market is as much to blame for endowments’ subpar performance as anything. In referring to my empirical results he says, “Endowment funds were outgunned by the never-ending rise of the S&P 500.” He cites return statistics for the S&P 500 in the 2009-2020 period and likens endowments’ challenge then to “...racing against Secretariat. You’re not going to win.” Huh? I do not reach conclusions about endowment performance using the S&P 500 as a benchmark. My benchmark includes small cap U.S. stocks as well as large, non-U.S. stocks and U.S. bonds — 72% globally-diversified, all-cap stocks and 28% investment-grade bonds. I show that endowments have consistently underperformed a benchmark that closely matches their effective market exposures and risk characteristics. Siegel makes an apples-to-oranges comparison in letting the endowments off the hook for weak performance. I say piffle, sir.

In the same vein, Siegel states that endowments’ poor showing over the past 12 years is due to their generally following “a low-beta strategy.” His argument is that alt-heavy portfolios should not be expected to keep up with stocks and bonds in rising markets, and suggests that their boats simply were not lifted by the rising tide of public market values during the bull market. Exhibit 2 provides performance statistics for three principal classes of alternative investments during the bull market that began in 2009. The statistics result from regressing those alts’ returns on ones of blended benchmarks of relevant stock and bond indexes.[8] All three asset classes have (positive) betas of approximately 1.0 and R2s that hover about 80%. These statistics, taken together, indicate that the alts moved decidedly with stock and bond markets in the bull market. At the same time, all three alts categories had negative alphas, averaging -3.3%. In other words, alt returns played out in accordance with their systematic risk and, thus, were not left behind in the bull market. Rather, they underperformed on a risk-adjusted basis. The main culprit in the alts’ underperformance was their annual cost of 2-4% of asset value.[9] Siegel discounts alts’ betas, which are alive and kicking, while overlooking their very ample negative alphas as the source of their lagging returns.

Exhibit 2

Performance Statistics for Private Equity, Hedge Funds and Real Estate During the Bull Market Beginning in 2009

|

|

Private Equity |

Hedge Funds |

Real Estate |

Average |

|

Beta |

1.02 |

1.00 |

0.98 |

1.00 |

|

Alpha |

-0.9% |

-3.1% |

-6.0% |

-3.3% |

|

R2 |

81% |

89% |

77% |

82% |

Sources: Asset class returns are from CEM Benchmarking

(Beath and Flynn, 2020), HFR and Cambridge Associates.

A more productive line of debate is whether or not there is reason to believe that the winning alternative investments of the 1990s and early 2000s — private equity, hedge funds and unlisted real estate — as classes of assets will ever become attractive again as sources of value-added investing. In anticipating a bounce-back in alt returns, Siegel’s argument ignores the fact that the Golden Age of Alts was a period in which private-market deal prices were incredibly cheap. This may never be the case again unless demand for alts falls. More generally, pricing in the alt markets is much more efficient now than it was 20 years ago as a result of huge cash inflows and maturation of markets. Alts have ceased to be diversifiers. And they cost 2-4% of asset value each year. What might change in the years ahead to alter what is, by my lights, a discouraging outlook for yesterday’s stellar alts?

SUMMING UP

I said in the introduction that Siegel chooses to expound on active investing in conceptual terms, with occasional reference to endowment management. I find the essay long on intellectual theory and short on proof. I am unmoved by the rationalization of endowments’ significant underperformance over 12 years and counting. The case for active investing looks past the elephant in the room — theory and evidence casting grave doubt on the merit of diversified — i.e., myriad-manager — active investing like that of endowments. The exceptionalism argument falls flat. The article sidesteps the glaring deficiencies of the EM. Siegel simply posits the presence of “skilled employees” in university investment offices who will get the job done despite obstacles of their own making. I find this explanation unconvincing. The endowment model is dead as a door nail.

WHAT LIES AHEAD?

What is the future of institutional portfolio management? “How to Improve Institutional Fund Performance” (Ennis, 2021b) makes recommendations for improving the odds of successful endowment management. The time has come for endowment managers to begin to explore simpler, more flexible concepts in asset allocation, gravitating away from asset-class silos that impose rigidity with no assurance of benefit. As they do, they should suspend the practice of maintaining de facto quotas for various types of active investments, such as 20% in private equity or 15% in hedge funds. Each and every active investment must earn a place in the portfolio based on its specific merits and estimated cost, without consideration for whether its type is a good fit or not. (Type, i.e., asset-class identity, has proven irrelevant.) Endowment managers must reduce cost and the number of actively managed portfolios they employ. Maintaining a passive core portfolio may be in their future as a means of gaining diversification more efficiently. In the end, endowment managers have to reconcile the reality of largely efficient and integrated markets (with their limited mispricing opportunities), the need for efficient diversification and cost. That challenge faces even the most skillful among them.

REFERENCES

Beath, Alexander D., and Chris Flynn. 2018. “Real Estate Performance by Implementation Style.” CEM Benchmarking Inc. https://www.cembenchmarking.com/research/Real_estate_by_implementation_style.pdf.

Ennis, Richard. 2020. “Institutional Investment Strategy and Manager Choice: A Critique.” Journal of Portfolio Management (Fund Manager Selection Issue) 46 (5): 104-117.

Ennis, Richard. 2021. “Endowment Performance.” Journal of Investing 30 (3): 6-20.

Ennis, Richard. 2021a. “Failure of the Endowment Model.” Journal of Portfolio Management (Investment Models Issue): 47 (5): 128-143.

Ennis, Richard. 2021b. “How to Improve Institutional Fund Performance.” Available at SSRN: https://ssrn.com/abstract=3816608 or http://dx.doi.org/10.2139/ssrn.3816608.

Harris, Robert S., Tim Jenkinson, Steven Neil Kaplan, and Ruediger Stucke. 2020. “Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds.” NBER Working Paper No. w28109. Available at SSRN: https://ssrn.com/abstract=3735676.

Sebastian, Michael D. 2012. “Public Funds Can Compete.” Available at SSRN: https://ssrn.com/abstract=2114449.

Siegel, Laurence B. 2021. “Don’t Give Up the Ship: The Future of the Endowment Model.” Journal of Portfolio Management (Investment Models Issue) 47 (5): 144-149.

[1] See Ennis (2021).

[2] I believe this overstates the potential for unconstrained investing by endowments. Educational institutions are the ultimate investors of conscience. They seemingly move from one moral dilemma to the next in managing their wealth. Divestment mandates have included companies doing business in South Africa, Darfur and Israel. Schools have faced pressure to divest themselves of tobacco, firearms and gambling. They are currently being forced to exclude fossil fuel investments and are retooling investment strategy to embrace ESG considerations more generally. In the mid-2000s, Harvard’s trustees experienced the sustained fury of the editors of The Crimson over the compensation of its highly successful investment staff, which resulted in the departure of key personnel and a reversal of performance. Constraints take various forms in the world of educational endowments. This is unlikely to change in the years ahead.

[3] The public fund composite has a returns-derived effective exposure to globally-diversified equites of 71% and investment-grade U.S. bonds of 29%. The equity allocation of the endowment composite is ever-so-slightly greater at 72%.

[4] See Ennis, 2020, pp. 106-7.

[5] See Ennis (2021a), pp.134-5.

[6] Sebastian (2012) observes that endowments underperformed public funds over the 2003-2011 period.

[7] The “persistence” problem has recently been extended to include private equity managers. See Harris et al. (2020).

[8] Real estate returns (from Cambridge Associates) and hedge fund returns (from HFR) are for the 12 years ended June 30, 2020. Private equity returns (from Beath and Flynn, 2020) are for the 10 years ended December 31, 2018. All three series begin with the bull market that began in 2009.

[9] See Ennis (2021a), p. 131, for a discussion of the cost of alternative investments in support of the 2-4% figure.